BTC Price Prediction: Technical Strength Meets Fundamental Tailwinds for Q4 Rally

#BTC

- Technical Strength: Price above key moving averages with Bollinger Band positioning suggesting continued upward potential

- Institutional Momentum: Record corporate adoption and treasury expansion creating sustained demand pressure

- Supply Dynamics: Scarcity index surge indicating tightening supply amid growing accumulation patterns

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

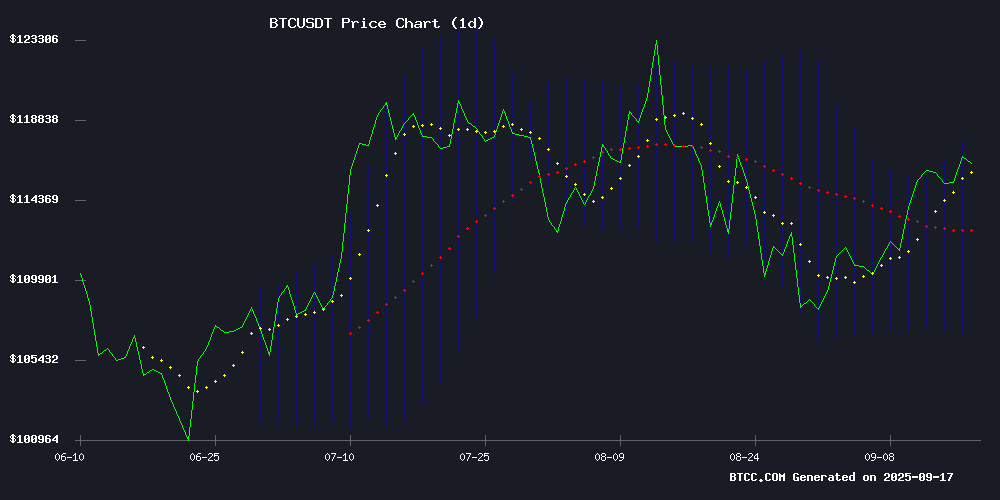

BTC is currently trading at $116,607, comfortably above its 20-day moving average of $112,468, indicating sustained bullish momentum. The MACD reading of -2581.56 remains negative but shows improving momentum with the histogram at -1746.82. Price action is positioned NEAR the upper Bollinger Band at $118,169, suggesting potential resistance ahead while maintaining strong support at the lower band of $106,766.

According to BTCC financial analyst Ava: 'The technical setup suggests consolidation with upward bias. Holding above the 20-day MA is crucial for maintaining the current bullish structure. Traders should watch for a break above the upper Bollinger Band for confirmation of continued upward movement.'

Market Sentiment: Institutional Accumulation and Scarcity Drive Optimism

Current market sentiment reflects growing institutional confidence with 75 new corporate adoptions in 2025 and expanding treasury allocations. The Bitcoin Scarcity Index surge on Binance indicates tightening supply dynamics, while retail bullishness reaches July highs ahead of the Fed decision.

BTCC financial analyst Ava notes: 'The convergence of institutional adoption, supply scarcity, and anticipation of favorable monetary policy creates a fundamentally supportive environment. Historical patterns suggest rate cut environments have previously correlated with significant BTC appreciation, with the $108K historical lesson providing relevant context for current market conditions.'

Factors Influencing BTC's Price

Bitcoin Traders Brace for Fed Decision as Retail Bullishness Hits July Highs

Market sentiment surged as the Federal Open Market Committee began its two-day meeting, with crypto traders anticipating a 25-basis-point rate cut. Santiment data shows retail Optimism at its highest since July, with 64% of social media chatter leaning bullish—a potential contrarian indicator.

Bitcoin hovered NEAR $115k amid cautious trading, as volume patterns suggested consolidation rather than decisive momentum. Futures markets overwhelmingly price in dovish Fed action, but analysts warn extreme retail euphoria often precedes short-term reversals rather than sustained rallies.

The CME FedWatch tool confirms near-unanimous expectations for monetary easing, creating asymmetric risk should policymakers deviate from consensus. Historical patterns show such one-sided positioning frequently coincides with local tops, tempering prospects for a straightforward post-announcement breakout.

Bitcoin Scarcity Index Surges on Binance as Supply Tightens

Bitcoin's resurgence above $115,000 has triggered a notable shift in market dynamics, with Binance's Scarcity Index spiking to levels last seen in June. The sudden tightening of supply suggests either large-scale withdrawals or a sharp reduction in sell orders on the world's largest crypto exchange.

Analysts interpret this movement as institutional or whale accumulation, with CryptoQuant's Arab Chain noting the index's Sunday surge reflects a classic supply shock precursor. The metric's behavior mirrors patterns observed during previous bull runs, where dwindling exchange reserves preceded major price advances.

Market mechanics now show decreasing BTC availability for spot trading just as the asset challenges its all-time high. This supply-demand imbalance on Binance—which typically sets the tone for global crypto liquidity—often precedes volatile upside movements when coupled with sustained buying pressure.

Corporate Bitcoin Adoption Hits Historic Levels With 75 New Firms in 2025

Corporate Bitcoin adoption continues its meteoric rise in 2025, with 75 companies adding BTC to their balance sheets—a record influx that underscores growing institutional acceptance. Public and private firms now collectively hold nearly 1 million BTC, cementing Bitcoin's role as both a strategic investment and inflation hedge.

Market euphoria shows signs of cooling, however. The Blockchain Group's stock has retreated from its 1,820% peak to +443%, while Metaplanet Inc. now trades just +55% above baseline after a 355% rally. This pullback suggests a maturing market where fundamentals increasingly outweigh hype.

The adoption timeline reveals accelerating momentum: from 6 corporate treasuries in 2020 to 75 new entrants in 2025 alone. This trajectory mirrors Bitcoin's evolution from speculative asset to institutional-grade reserve currency—a transition now entering its most aggressive phase.

French Authorities Shut Down Darknet Market DFAS, Seize 6 BTC

French law enforcement has dismantled Dark French Anti System (DFAS), a prominent darknet marketplace operating since 2017. The platform facilitated drug trafficking, arms sales, and money laundering, serving as a hub for Francophone organized crime.

Authorities arrested two individuals and confiscated over 6 BTC, valued at approximately €600,000. The seizure underscores Bitcoin's continued use in illicit transactions despite broader institutional adoption.

Cyberdouane, France's cybercrime unit, monitored DFAS for years as its user base expanded. The takedown reflects growing global coordination against darknet operations leveraging cryptocurrencies.

Bitcoin Market Stabilizes as Analysts Eye Q4 Recovery

Bitcoin has reclaimed key support levels after a three-week downtrend, signaling potential stabilization ahead of October. The cryptocurrency now trades at $115,550, up 2.2% weekly, with Bitfinex analysts noting strengthened technical foundations for recovery.

Market capitalization across digital assets surged 4.8% this week, adding $180 billion. On-chain data reveals accumulating behavior, with investors deploying buy-the-dip strategies near the $107,500 support zone.

Bitcoin's Neutral NVT Golden Cross Suggests Room for Growth Amid Miner Holding Patterns

Bitcoin's NVT Golden Cross holds steady at 0.3, signaling neither overheating nor undervaluation. This neutral positioning historically precedes price expansion cycles, with levels above 2 typically marking cycle tops. The metric's current reading suggests healthy upward momentum without immediate speculative excess.

Miners appear to be accumulating rather than selling, despite a 150% spike in the Miners' Position Index. At 0.10, the MPI remains well below levels that WOULD indicate significant selling pressure. This holding pattern reduces immediate downside risks.

Exchange inflows show moderate activity, with a 3.17% rise in CDD suggesting some long-term holders may be preparing to take profits. The movement remains contained, reflecting measured profit-taking rather than panic selling during Bitcoin's current rally.

Bitcoin Scarcity Index Spikes For First Time Since June: Accumulation In Play?

Bitcoin stands at a critical juncture as analysts debate its next trajectory. Divergent views emerge—some warn of waning demand and potential deeper corrections, while others anticipate a breakout surpassing all-time highs. The market's tension stems from the impending US Federal Reserve interest rate decision, a pivotal catalyst for near-term price action.

CryptoQuant data reveals a notable signal: Binance's bitcoin Scarcity Index surged yesterday, marking its first significant movement since June. Such spikes typically indicate structural shifts—either large BTC withdrawals from exchanges or a sharp decline in sell orders. Both scenarios constrict available supply, amplifying Bitcoin's scarcity.

Historical patterns link these movements to institutional accumulation or aggressive whale buying. The timing heightens stakes, with the Fed's policy decision poised to trigger a decisive market MOVE that could define Bitcoin's trajectory through year-end.

Bitcoin's Fed Rate Cut Echoes: A $108K History Lesson

Bitcoin's trajectory faces a critical test as Federal Reserve policy decisions loom. The cryptocurrency's current $115K valuation mirrors December 2024's pivotal moment when BTC peaked at $108K before a 20% collapse following a Fed rate cut.

Derivatives markets show alarming parallels to 2024's overheated conditions, with traders accumulating aggressive long positions. The Fear & Greed Index's neutral 50 reading reflects market paralysis ahead of the Fed's next move.

Glassnode data reveals Short-Term Holder Net Unrealized Profit/Loss (NUPL) hovering near danger zones. When this metric last turned negative in 2024, it triggered a 12-week bear cycle that vaporized bullish momentum. Current STH realized price sits at $110K - a potential tipping point for another capitulation event.

Bitcoin Treasury Expansion Continues as Capital B Joins Institutional Accumulation Trend

European investment firm Capital B has entered the Bitcoin treasury arena with a strategic acquisition, reinforcing the growing institutional conviction in BTC's long-term value. The move comes as Bitcoin maintains its position above $115,000, steadily approaching its all-time high.

Michael Saylor's pioneering treasury strategy continues to gain global traction, with corporations worldwide allocating portions of their reserves to Bitcoin. Capital B's recent purchase establishes it as Europe's first dedicated BTC treasury company, signaling deepening institutional participation in the digital asset space.

The sustained accumulation by both retail and institutional investors underscores Bitcoin's dominant position in the current bull market cycle. Treasury strategies have evolved from niche corporate experiments to mainstream financial instruments, with BTC increasingly viewed as a Core reserve asset.

Dormant Bitcoin Whale Activity Aligns With Market Volatility

Bitcoin's price action has entered a consolidation phase following its near-$124,000 all-time high, with volatility keeping traders on edge. The cryptocurrency now trades in a tight range, exhibiting resilience but lacking clear directional conviction. This equilibrium mirrors pivotal moments in past cycles where breakout rallies or corrections followed periods of indecision.

On-chain analyst Maartunn observes a telling pattern: 7,547 BTC dormant for 3-5 years recently changed hands. Such whale movements historically correlate with significant price reactions. The timing coincides with macroeconomic uncertainty surrounding Federal Reserve policy, adding layers to market interpretation.

Long-term holders appear to be repositioning while short-term traders navigate choppy waters. The alignment between dormant coin movements and price volatility suggests accumulating energy for Bitcoin's next major move. Market structure now resembles a coiled spring - the direction of release remains uncertain, but the potential for explosive action grows daily.

Crypto Leaders Advocate for U.S. Strategic Bitcoin Reserve Bill

Michael Saylor, co-founder of MicroStrategy, alongside Marathon Digital Holdings CEO Fred Thiel and other industry leaders, convened in Washington, D.C. to endorse a legislative proposal for a U.S. strategic Bitcoin reserve. Hosted by Senator Cynthia Lummis and Representative Nick Begich, the roundtable marked a push to formalize Bitcoin's role akin to Gold in national reserves.

The bill mandates the acquisition of one million BTC over five years, potentially leveraging seized assets—a framework echoing a prior executive order from the TRUMP administration. This move coincides with Congress advancing its first major crypto legislation on stablecoins, signaling broader regulatory momentum.

Advocates, including the Digital Power Network, argue that a Bitcoin reserve is critical for maintaining U.S. competitiveness in digital assets. While currently backed only by Republican lawmakers, efforts are underway to secure bipartisan support ahead of committee hearings.

Notable attendees included executives from Bitdeer, Riot, and Cleanspark, underscoring industry-wide alignment on the proposal's strategic importance.

Is BTC a good investment?

Based on current technical indicators and fundamental developments, BTC presents a compelling investment opportunity. The price trading above key moving averages, combined with record institutional adoption and supply scarcity, creates favorable conditions for potential appreciation.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | +3.68% above | Bullish |

| Bollinger Position | Upper band proximity | Neutral/Bullish |

| Institutional Adoption | 75 new firms in 2025 | Very Bullish |

| Scarcity Index | Surge pattern | Bullish |

While MACD remains negative, the improving momentum and strong fundamental backdrop suggest BTC is well-positioned for potential growth, particularly as market analysts eye Q4 recovery patterns.